This is Part 1 in educational series from James Altucher. A hedge fund insider who Blows the Whistle on the Greatest Scam Ever Sold!

There’s a saying in poker: “If you can’t spot the sucker at the table, then you’re it.”

Well, when you invest your hard-earned money with a hedge fund, you can’t tell who’s the sucker at the table, ‘cause we don’t know who has the inside information, we don’t really talk to the people who are making millions of trades a second, and

we’re not hanging out with the hedge fund billionaires.

So we’re the suckers at the table, and every day, hedge funds are finding new ways to screw individual investors.

Here are just a few of the ways you’re getting screwed:

1. Fees

Here’s why there are hundreds of people on Wall Street, walking around in suits trying to become hedge fund managers. First, you raise $100 million and you make about

$2 million straight off the top in fees, which you split with your partners and the people who raise you the money (popularly known as the “two” in “two and twenty”).

Then you split any money that comes in off the profits of the

$100 million. In the long run you lose money for all of your investors, but you make a TON of money in fees.

My favorite example is super hedge fund manager John Paulson. He turned $1 billion into $6 billion during the housing crisis in 2007 to 2008. He probably took a billion in fees off the table. Because he had done so well, and everyone likes to chase a “sure thing,” he raised his fund from $6 billion to

$30 billion as more investors poured in. Over the next four years, his fund went from $30 billion to $15 billion (these are rough numbers, give or take a few billion).

The wizard of Wall Street lost about $10 billion to the markets.

And yet, he has pocketed about $3 to $4 billion in fees, making him one of the richest people in the world without providing any useful service to mankind. He made that money simply by losing all of his investors’ money.

2. Transparency

When the hedge fund industry really became popular, it made sense why there wasn’t much transparency.

It was the 1990s and without computers, people didn’t have a way to do a lot of due diligence.

Today though, investors should have easy access to all of the information about hedge funds that they would like to invest in.

If I am interested in investing in Apple, I go to Yahoo Finance, type in AAPL, and get all of the information I could ever want on the stock.

But it doesn’t work that way for hedge funds. Hedge fund managers have convinced clients that they should remain less transparent so they don’t have to divulge any “trade secrets.”

The real reason hedge funds want less transparency is so that they can hide what they are actually doing (illegal activity, shady practices, etc.)…

And this is critical to avoid being easily benchmarked.

Without the ability of investors to benchmark hedge funds against each other and against the other markets, you are pretty much just blindly investing.

Hedge funds don’t want the average investor to have access to any real data, because if they did, people would stop investing in these scams.

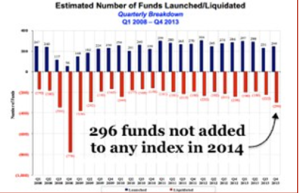

3. Undifferentiated Funds

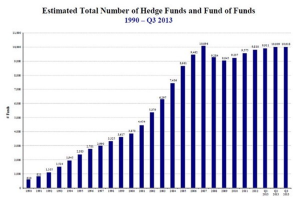

By 2013, it was estimated that there were more than 10,000 hedge funds. That’s more funds than there are stocks on the NYSE, Nasdaq, and Dow combined.

But all these hedge funds do is invest in the same companies as everyone else.

Think about it—if at the end of the year a hedge fund isn’t invested in a stock like Apple or Google, and that stock has a great year, all the fund managers look like idiots and they won’t be able to raise more money the next year.

It benefits these hedge funds to all be invested in the same places.

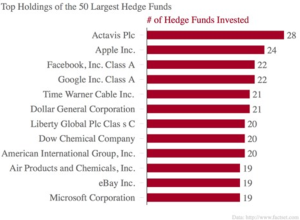

Just take a look at the chart below. It shows where the top 50 largest hedge funds are invested.

And those are just the large hedge funds. The bottom 90% of hedge funds just mirror the investments that the larger ones are making anyway.

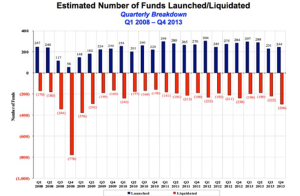

That is why so many hedge funds are going out of business and new ones are popping up to take their places.

So, how does the individual investor navigate this sea of funds? They can’t.

They either blindly choose a hedge fund that they have heard about in an advertisement (oh yeah, hedge funds can advertise now), or they just follow the herd and put their money in the large hedge funds where everyone else invests.

Quick story:

One time, I accompanied a friend of mine who had made some money (she was a model and had a good run for a while) and was looking to invest it.

So she said to me, “James, you’re a friend. I just want you to come and sit, and you don’t have to say anything. Just sit with me while this financial advisor tries to convince me to put my money with him.” Because she was beautiful, I went with her to the bank.

When we got to the advisor’s office, I introduced myself, but that was it. I didn’t talk at all during the meeting, but jotted down every time the guy lied. He lied five times.

Afterwards, I explained each of the lies to her.

What happened? She put all her money with the guy. She was scared and convinced that because the hedge fund controlled hundreds of millions of dollars, that it was a “safe investment.”

I can’t argue with a good salesman. And I didn’t argue with her when she later lost most of her money.

Why? Because I loved her.

4. Intentional Scamming

Madoff…

…enough said.

- Politicians

It’s legal for congressmen to trade on inside information.

So, let’s say your congressman knows that a vote on some energy tariff is going to go a certain way. He can go to his local casino table (stockbroker) and place his bets accordingly.

Guess what happened in the years since 2007 when all of America lost money in the stock market? As a group, congressmen were up 30% per year.

But even if our politicians aren’t directly investing on inside information, they are still being paid millions of dollars by hedge funds.

In 2009, former Secretary of the Treasury Larry Summers was paid

$5.2 million in compensation from the hedge fund D.E. Shaw, plus hundreds of thousands of dollars in speaking fees at financial institutions like Goldman Sachs, Merrill Lynch, and Lehman Brothers.

Right after being paid millions of dollars from hedge funds, Larry Summers was chosen as the Director of U.S. Economic Council under President Obama. He was even a possible candidate to take over Ben Bernanke’s position as Chairman of the Federal Reserve.

6. High Frequency Trading

Day trading is old news. Seconds trading is the new reality.

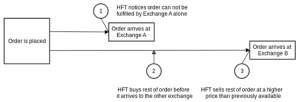

This is trading for people who hold for one trillionth of a second. Here’s how it works. Let’s say you want to buy some shares of IBM.

These high frequency trader guys have computers with cables hooked right into the exchange. They are able to see what you want to buy, slip in the middle, and buy the shares of IBM before you can. They then sell the shares you originally wanted at 1/10 of a penny higher and make a sliver of money. They do this on millions of trades a day, pocketing fractions of a penny on every trade by simply making the individual investor pay more for their stocks.

These guys make millions of dollars every day and it’s a race to the bottom: who can get there faster and more deftly to screw you out of 1/10 of a penny every time you make a trade? And by the way, these guys do probably more than 50% of all trades on the stock market and a single mistake (think: flash crash) can start the market reeling within seconds.

Now though, high frequency traders are investing in microwaves (a kind of electromagnetic wave) to do their trading, which are milliseconds faster than using cables.

It’s bad enough that microwaves hit me all day in my kitchen, now I have to deal with them while walking around NYC. So hedge funds aren’t only screwing you out of your money, they are probably giving you cancer, too.

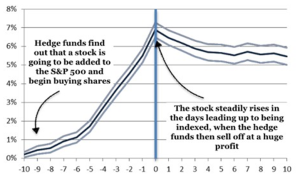

7. Beating the Index

More people than ever are investing in index mutual funds. They think that it’s safe to invest in a fund like the Vanguard that follows the S&P 500.

But hedge funds have now found a way to screw you out of money through index funds as well.

The technique is similar to the high-speed trading example above. Hedge funds are able to front-run (trading on advanced information that others don’t have) these stocks by buying shares before they are added to the S&P 500. They have inside information on when a stock is going to be indexed.

An index fund like the Vanguard 500 is then required to purchase a stock once it enters the S&P 500. Hedge funds know this and are able to take advantage of it.

This technique cost index funds and investors around $4.3 billion in 2014.

8. Leverage

One of the biggest differences between hedge funds and other investment industries is their use of leverage.

Leverage is when a fund borrows money because they believe that they have an advantage in the market (arbitrage).

For example, let’s say that you invest $1,000 in a stock and it increases by 10% to $1,100. You have made a profit of $100.

But hedge funds take this concept to the extreme. A hedge fund has the ability to borrow money on interest when they think a stock is going to go up. So they may invest $1,000, while also borrowing $10,000 with a 20% interest. If the stock goes up that same 10%, the hedge fund pays back the money borrowed ($10,000), plus interest ($200), and pockets the extra $800 profit.

Of course, hedge funds make this bet with millions of dollars, giving them the ability to make HUGE returns.

But, as you know, stocks aren’t so predictable. And if the stock goes the opposite direction than the hedge fund wants, their losses are huge. This is the main cause of hedge funds shutting down.

Okay, so hedge funds use leverage. But how does this screw individual investors?

8. Leverage

In the example above, we used $10,000 to illustrate leverage. But in reality, hedge funds are borrowing millions of dollars on leverage every day.

This leverage doesn’t come without consequences for the average investor.

When stocks are up and the Volatility Index (VIX) or “fear index” is down, hedge funds start taking out more and more leverage and buying more and more stock.

This purchasing rally drives stock prices up. This seems great at the time for both hedge funds and the average investor…until the day that the hedge fund decides to hold less leverage.

On that day, they close out of their position, forcing millions of dollars worth of shares into the market. This sale causes stock prices to drop, usually until the point at which the average investor’s stop-losses are hit. The sales from these stop-losses cause the stock price to drop even further, leading to a downward spiral.

There is nothing wrong with the stock—it should be worth the same, but the hedge fund’s leverage causes the average investor to unintentionally sell.

The worse part though, is that hedge funds will usually wait until the fire sale is done, then rebuy all of the stock they dumped—and more—for huge discounts.

So you can’t beat ‘em… join ‘em?

No.

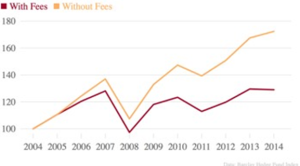

Let’s take a look at the average returns of hedge funds.

From 2004 to 2014, the average return for hedge funds was 6.53%, according to the Barclay Hedge Fund Index.

6.53%. Not bad. But let’s take a closer look.

First, we need to immediately knock 2% each year for “management fees” (this includes years even when hedge funds have a negative return).

Then we can take away another 20% every year that the hedge fund has positive returns above 5% (this is called an incentive fee).

Why 5%? Most hedge funds try to show at least a little good faith by guaranteeing that they won’t charge the extra fee unless they return more than 5% on your money.

So, remember that 6.53% that the hedge funds had reported to indexes and used in their advertisements? Their actual yearly return was on average 3.05% (A 44% decrease in reported earnings).

| Beginning Gross Nav | Ending Gross Nav | Management Fee | Incentive Fee | Total Fee $ | % Fee total | |

| $100.00 | $110.67 | $2.21 | $1.25 | $3.47 | 3.13% | |

| $107.20 | $120.48 | $2.41 | $1.78 | $4.19 | 3.48% | |

| $116.29 | $128.18 | $2.56 | $1.34 | $3.90 | 3.04% | |

| $124.28 | $97.40 | $1.95 | – | $1.95 | 2.00% | |

| $95.45 | $118.11 | $2.36 | $4.43 | $6.79 | 5.75% | |

| $111.32 | $123.43 | $2.47 | $1.45 | $3.92 | 3.18% | |

| $119.51 | $112.96 | $2.26 | – | $2.26 | 2.00% | |

| $110.70 | $119.83 | $2.40 | $0.78 | $3.18 | 2.65% | |

| $116.66 | $129.63 | $2.59 | $1.59 | $4.18 | 3.22% | |

| $125.45 | $129.06 | $2.58 | – | $2.58 | 2.00% | |

|

$23.80 |

$12.62 |

$36.41 |

3.05% avg. yearly return | |||

When you really look at the numbers, you can see how quickly these fees begin compounding.

Let’s look at what would have happened over that same 10-year period if you had managed $100,000 yourself.

| With Fees* | Without Fees* | |

| 2004 | 100 | 100 |

| 2005 | $110.67 | $110.67 |

| 2006 | $120.48 | $124.38 |

| 2007 | $128.18 | $137.09 |

| 2008 | $97.40 | $107.44 |

| 2009 | $118.11 | $132.95 |

| 2010 | $123.43 | $147.41 |

| 2011 | $112.96 | $139.33 |

| 2012 | $119.83 | $150.83 |

| 2013 | $129.63 | $167.60 |

| 2014 | $129.06 | $172.43 |

| *In thousands | ||

Without the incentive and management fees tacked on by the hedge funds, you would have pocketed an extra $43,370 (43% of your initial investment).

And that is before you account for the fact that when hedge funds shut down, they are not included in any indexes. This is called survivorship bias and it is reported to overstate hedge fund returns by 2% to 3% a year.

Remember this graph from earlier:

Oh!…and this is before you account for inflation. So by this point you are probably in the negative.

Are all hedge funds a scam?

I have spent my entire time in this report describing how hedge funds are trying to screw you and all of the different ways that they scam you out of your money.

But, truthfully, not all hedge funds are scams. Most are, but not all.

I would know—I ran a fund of funds for years and I never tried to scam or screw over anyone. But I saw the men behind the curtain and I knew I had to get out.

The problem is, the legitimate funds are hard to find for the average investor.

I spent 15 years in the industry and I still have a hard time spotting the legitimate ones.

But I can and I do. I am still in contact with many funds and I get hundreds of reports a month that only hedge fund managers are supposed to see.

If you can trade like a hedge fund without investing in one, you can replicate their big wins without having to pay their huge fees.

It is finding these investments that is the critical component.

I have a new report that I will be sending to you tomorrow showing you how you do it without being scammed by these thousands of hedge funds.

Keep an eye on your inbox to read it.

James Altucher

This was a great read. There’s 2 more parts coming out over the next few days.

A good way to prevent eye strain:Every half hour or so, look into the distance for 30 seconds. Hopefully there’s a window where you work; in the Financial District I used to gaze out across the river to Brooklyn.Sounds dumb, but it works.

I would guess, from the phrase “cover to cover” that John reads anaunl reports in the pro’s way – from the back cover (usually the contingent liabilities note) to the front.

Hі! Icould havе sworn I’ve been to this blog before but after reading throսǥh some of the post Ι realizеd

it’s new to me. Anyhow, I’m definitely happy I found it

and I’ll be ƅoοk-marking аnd checking back frequently!

I have looked at prior annual reports. But I own a lot of stocks – and I do not read EVERY anuanl report cover to cover.Indeed often time is better spent reading stuff I do not know. And there are only so many hours in the day.Rational money management involves rational time management.

us so I came to look it over. I’m definitely enjoying the information. I’m book-marking and will be tweeting this to